10 AMR Robot Companies Making Headlines in 2025

The most prominent AMR robot companies making headlines in 2025 include ForwardX Robotics, Locus Robotics, Geekplus, Fetch Robotics, Omron, ABB, KUKA AG, Boston Dynamics, Robotize, and Nimble Robotics. These leading AMR companies drive innovation in robotics, logistics, and automation across industries. Autonomous mobile robots (AMRs) use advanced AI, sensors, and software to navigate and automate tasks. The global AMR market is projected to reach $4.60 billion in 2025, with rapid adoption in logistics and manufacturing.

Metric/Aspect | Statistic/Projection |

|---|---|

Projected Market Size (2025) | |

CAGR (2025-2033) | 15.40% |

E-commerce Segment CAGR | 30.4% |

Amazon AMRs Deployed | Over 750,000 robots |

Key innovations include AI-powered decision making, precise LiDAR navigation, and seamless integration with business software. Readers should look for how these top robotics companies achieve industry impact, global reach, and set benchmarks among the top 20 AMR robot companies and amr companies worldwide.

Key Takeaways

The AMR market is growing fast, expected to reach $4.6 billion in 2025 with strong demand in logistics and manufacturing.

Top AMR companies use AI, sensors, and advanced navigation to improve efficiency and safety in warehouses and factories.

Leading companies like ForwardX Robotics, Locus Robotics, and Boston Dynamics offer innovative robots that boost productivity and reduce labor costs.

AMRs work safely alongside humans by detecting obstacles and adapting their paths in real time.

Future trends include smarter AI, energy-efficient robots, and flexible rental models that make robotics more accessible.

About AMRs

What Are AMRs

Autonomous mobile robots have transformed the way industries handle repetitive and complex tasks. These robots use advanced sensors, AI-powered robotics, and computer vision to move and operate without human intervention. Their core features include autonomous navigation, real-time obstacle avoidance, and multi-robot collaboration. Companies deploy these robots in warehouses, manufacturing plants, hospitals, and even urban environments.

Aspect | Details |

|---|---|

Autonomous navigation, AI algorithms, sensor technologies (LiDAR, cameras, ultrasonic sensors), computer vision, cloud computing, multi-robot collaboration | |

Key Technologies | Multimodal navigation (LiDAR + vision + IMU fusion), AI-driven voice interaction, swarm intelligence, bionic drives, modular design |

Industry Applications | Warehousing & logistics, manufacturing, healthcare, agriculture, urban management |

Performance Enhancements | Intelligent algorithms for path planning and obstacle avoidance, advanced sensors, cloud-based data processing |

Future Trends | Higher intelligence, ultra-high-precision navigation, all-terrain adaptability, human-robot collaboration, modular designs |

Market & Policy Context | Supported by policies like "Intelligent Manufacturing 2025", growing demand in logistics, healthcare, manufacturing |

Representative Innovations | Boston Dynamics Stretch robot, Haikang Robotics' AI and IoT-based AMRs, Geek+ Galaxy system |

These robots rely on ai-driven navigation and cloud computing to adapt to changing environments. Their modular design allows for easy upgrades and customization. As robotics technology advances, industries see more robots working alongside humans, improving efficiency and safety.

Industry Growth 2025

The robotics industry continues to expand rapidly in 2025. Autonomous mobile robots play a central role in this growth, especially in logistics, manufacturing, and healthcare. The workforce in robotics-related sectors reached over 2.23 million employees in 2024, with compensation totaling $257 billion. Wages in this field stand 56% higher than the national average, highlighting the value of robotics expertise.

Metric | Historical and Current Data Highlights |

|---|---|

Workforce Size | Over 2.23 million employees in 2024, with an increase of 100,000 in 2024 |

Compensation | $257 billion total in 2024 |

Wage Comparison | Wages 56% higher than the national average |

Industry Role | Leading in job creation, economic output, trade, technology, and security |

Data Span | Annual reports from 2018 through 2025 reflecting industry evolution |

The logistics and warehousing segment holds a 33.6% market share in 2024, driven by e-commerce and automation needs.

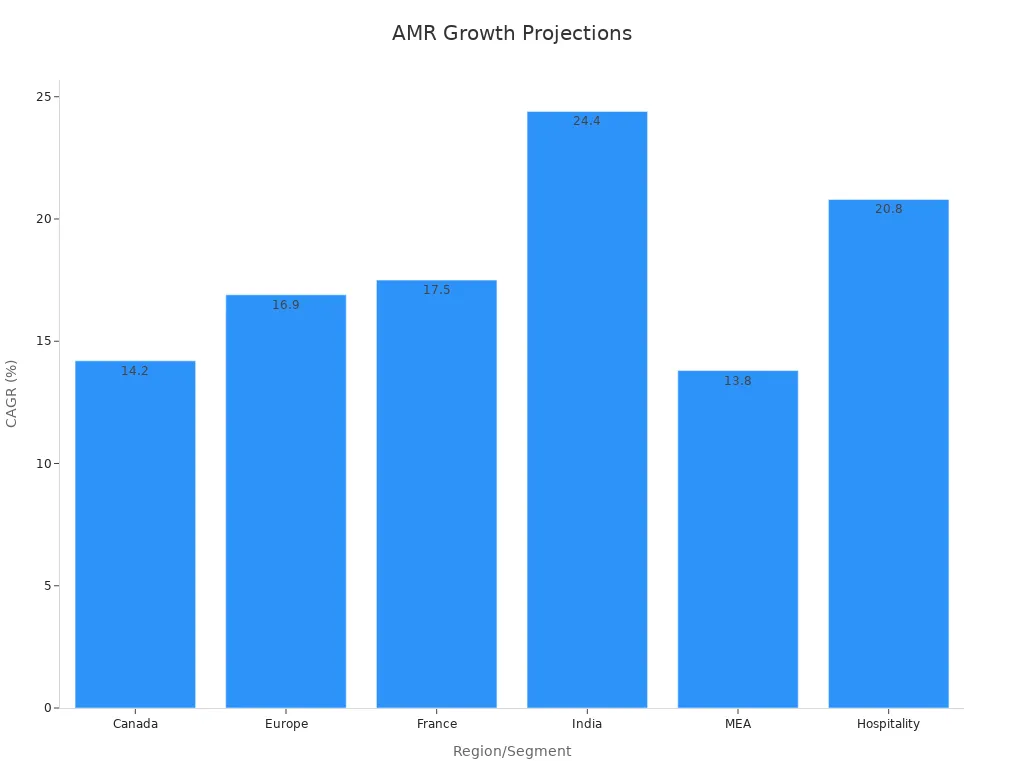

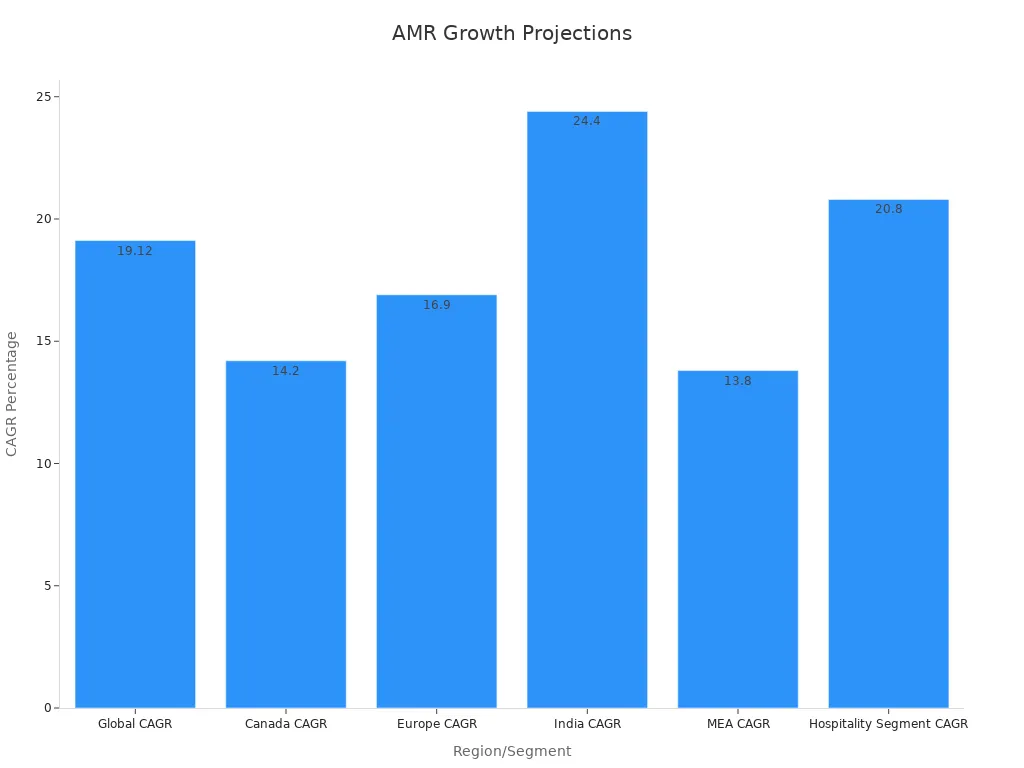

Global market projections show the AMR market reaching $21.46 billion by 2032, with a CAGR of 19.12% from 2025 to 2032. North America leads with a 33.8% market share, fueled by e-commerce and manufacturing automation. India shows the fastest growth, with a CAGR of 24.4%, as government initiatives and e-commerce expansion drive adoption. The hospitality sector also sees rapid growth, with a CAGR of 20.8%, as businesses address labor shortages through robotics.

The rise of ai-powered robotics and autonomous mobile robots signals a new era for industry. Companies invest in robotics to boost productivity, reduce costs, and stay competitive in a changing global market.

Top 10 AMR Robot Companies 2025

ForwardX Robotics

ForwardX Robotics stands out among amr robot companies for its advanced perception and navigation systems. The company integrates Laser SLAM with computer vision, enhanced by proprietary deep learning algorithms. This fusion of LiDAR and camera data improves mapping accuracy and reduces errors. ForwardX AMRs classify and recognize obstacles, such as humans, shelves, and forklifts, rather than treating them as generic barriers. Adaptive navigation behaviors, including slowing for humans and overtaking vehicles, boost safety and efficiency.

A notable deployment at Chery Automobile’s Dalian EV factory involved 435 AMRs, supporting the production of one car every 100 seconds. The Flex Series handles tight spaces, the Max Series manages heavy-duty loads, and the Lynx Series specializes in towing. These scalable solutions reduce manual touchpoints and improve workflow reliability. ForwardX’s long-term partnership with Chery highlights its role in Industry 4.0 readiness.

ForwardX Robotics leads the market with scalable, intelligent automation, making it a key player among the top 20 amr robot companies.

Locus Robotics

Locus Robotics has become a leader in warehouse automation, especially in North America and Europe. The company introduced the LocusHub business intelligence engine in 2024, which uses AI and machine learning to provide predictive insights. This technology helps warehouses boost productivity and reduce costs.

Locus Robotics focuses on operational efficiency, meeting the demands of e-commerce for faster order fulfillment and better inventory management. Its AMRs work alongside human workers, optimizing picking and transport tasks. The company’s strong market presence and ongoing innovation position it among the top robotics companies in the logistics sector.

Locus Robotics’ AMRs:

Integrate with warehouse management systems

Use AI for route optimization

Support scalable fleet deployments

Geekplus

Geekplus has made significant contributions to automation and robotics, especially in e-commerce logistics. The company’s partnership with YesAsia led to a 99.9987% picking accuracy, a 20% increase in order fulfillment efficiency, and a 65% reduction in manual workloads. A detailed survey reported 100% positive feedback from YesAsia’s operational team, highlighting financial gains and advanced technology adoption.

Geekplus has deployed over 7,000 warehousing and sorting robots worldwide, serving more than 100 clients across industries like retail, third-party logistics, and manufacturing. Its AI-driven robotic solutions enhance efficiency in order fulfillment, material handling, and sorting. The company’s focus on customer satisfaction and rapid local support drives its expansion, including plans for a second smart warehouse deployment in 2025.

Fetch Robotics

Fetch Robotics delivers flexible robotic solutions for materials handling, fulfillment, and warehouse automation. Its AMRs, combined with Zebra industrial scanners, have improved operational efficiency for clients like Bespoke Manufacturing. Waytek replaced traditional conveyors with Fetch’s AMRs, increasing throughput and optimizing space.

Fetch Robotics integrates artificial intelligence to enhance robot autonomy and decision-making. Its collaborative robots and mobile robots improve operational flexibility, while software orchestration platforms enable scalable fleet management. Partnerships with technology leaders and compliance with safety standards ensure reliable and safe human-robot collaboration.

Key features:

AI-driven autonomy

Scalable fleet management

Compliance with safety standards

Omron

Omron ranks among the leading amr companies, especially in heavy-duty industrial manufacturing. Its AMRs use advanced sensors and navigation technology for autonomous operation and safe human interaction. Omron’s solutions integrate seamlessly with warehouse management and ERP systems, enabling smooth deployment.

The company offers a comprehensive portfolio, including automation platforms, machine vision, predictive maintenance, and IIoT. Omron’s high-payload AMR models, introduced in 2021, handle loads of 5 tons or more. Robust construction and sophisticated sensors ensure reliable operation in demanding environments. Omron’s global network provides extensive support, including safety training and proof of concept centers.

Aspect | Details |

|---|---|

Market Position | Leading in heavy-duty AMRs for manufacturing |

Payload Capacity | |

Integration | WMS and ERP compatibility |

ROI | High, due to labor cost reduction and throughput |

Support | Global network, safety training, technical support |

ABB

ABB remains a global leader in robotics and automation, serving industries such as manufacturing, utilities, and construction. The company offers a broad portfolio, including articulated robots, collaborative robots (cobots), SCARA robots, delta robots, and intelligent AMRs. ABB’s robots are known for reliability, safe human-robot collaboration, and seamless integration with existing systems.

AI integration enables predictive maintenance and advanced automation. ABB’s articulated robots perform complex tasks like welding and assembly, while cobots assist humans in repetitive or precision tasks. The company’s historical performance includes employing over 100,000 people and generating nearly $30 billion in annual revenue. ABB’s ongoing innovation and plans to list its robotics division in 2026 underscore its leadership among amr robot companies.

KUKA AG

KUKA AG holds a strong position in the global AMR market, especially in industrial manufacturing and logistics warehousing. The company focuses on AI-powered path planning, obstacle avoidance, and cloud-based fleet management. KUKA’s AMRs offer high payload capacity, navigation accuracy, and operational flexibility.

Aspect | Details |

|---|---|

Market Size (2025 est.) | ~$2.5 billion in heavy-duty AMRs |

CAGR (2025-2033) | ~15% |

Key Markets | North America, Europe, East Asia |

Innovation Focus | Payload, navigation, battery life, flexibility |

Market Trends | Industry 4.0, heavier payloads, dynamic tasks |

KUKA’s solutions support Industry 4.0 adoption, handling complex tasks in dynamic environments. The company’s global reach and technological innovations secure its place among the top amr robot companies.

Boston Dynamics

Boston Dynamics continues to influence the AMR sector with engineering breakthroughs like the Stretch robot. Stretch is designed for warehouse automation, integrating mobile manipulation, navigation, and sensing to handle demanding tasks such as case handling. This robot addresses ergonomic challenges and labor demands in fast-paced environments.

Boston Dynamics’ innovations in mobile manipulation and onboard intelligence set new standards for efficiency. Stretch can unload up to 1,000 cases per hour, significantly reducing labor costs. The company’s focus on advanced robotics and real-world deployment keeps it at the forefront of amr robot companies.

Robotize

Robotize specializes in flexible AMR solutions for manufacturing and logistics. The company’s GoPal series of AMRs automate internal transport tasks, improving workflow efficiency and reducing manual labor. Robotize’s robots feature user-friendly interfaces and seamless integration with existing systems.

The company’s solutions support a range of industries, including automotive, electronics, and food processing. Robotize emphasizes safety, reliability, and adaptability, making its AMRs suitable for dynamic production environments. Its focus on customer-driven innovation and rapid deployment has earned it recognition among top robotics companies.

Nimble Robotics

Nimble Robotics exemplifies the new wave of accessible and affordable robotics. The company leverages AI and off-the-shelf components to accelerate robot design and functionality. Nimble Robotics supports warehouse automation by integrating robotic systems with warehouse management systems for efficient picking operations.

The rise of robotics-as-a-service (RaaS) allows companies to rent robots on flexible contracts, lowering upfront costs. The average cost of industrial robots has dropped from $68,000 in 2005 to under $11,000 in 2025, enabling broader adoption. Nimble Robotics’ focus on rapid deployment and customization aligns with industry trends toward streamlined, task-specific robots.

Nimble Robotics’ innovations make robotics more accessible, supporting its recognition as a top company in 2025 and advancing robotic solutions for healthcare, logistics, and manufacturing.

The top AMR robot companies in 2025 set new standards for robotics innovation and industry impact. Robotics continues to evolve, driven by AI-powered navigation, energy efficiency, and expanding applications. Companies invest in research and strategic partnerships to address automation needs.

Businesses should explore robotics solutions that align with their operational goals and stay informed about emerging trends.

Aspect | Highlights |

|---|---|

Automation demand, IoT integration, cost reduction, urbanization, and industrialization | |

Future Research | AI integration, energy-efficient robotics, human-robot collaboration, cybersecurity |

Ongoing research and adaptation will help organizations maximize the benefits of robotics in a dynamic market.

FAQ

What is the main advantage of using AMRs in warehouses?

AMRs increase efficiency by automating repetitive tasks. They navigate complex environments and work alongside humans. Companies see faster order fulfillment and reduced labor costs.

How do AMRs differ from traditional automated guided vehicles (AGVs)?

AMRs use advanced sensors and AI to navigate without fixed paths. AGVs follow set routes, often needing physical guides. AMRs adapt to changes, making them more flexible for modern robotics applications.

Which industries benefit most from AMR deployment?

Industries such as logistics, manufacturing, and healthcare benefit the most. These sectors use robotics to improve productivity, safety, and accuracy in daily operations.

Are AMRs safe to operate around people?

Yes, AMRs use sensors and AI to detect obstacles and people. They adjust speed and direction to avoid collisions. Safety standards guide their design and deployment.

What trends will shape the future of AMRs?

Key trends include AI integration, energy efficiency, and robotics-as-a-service models. Companies also focus on human-robot collaboration and expanding applications across new industries.